Frictionless payments experiences powered by a modern, end-to-end payments technology platform.

Headache-free merchant

services that grow with you—and move you forward.

Trusted across every industry, Fidelity offers a full suite of customizable payment solutions and one-on-one support to help you streamline your daily operations, fight fraud, lower costs and power your growth.

It's extremely rare these days to find an organization that truly understands client service. Thanks Josh and Team for putting us first and providing such a smooth seamless experience!

”The future of integrated payments, today.

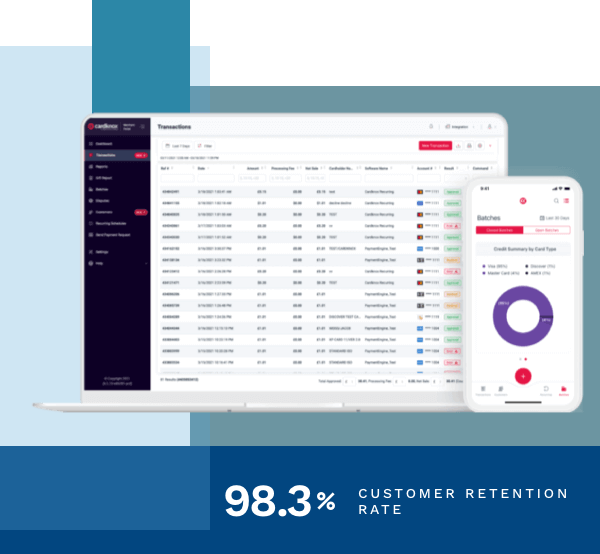

Cardknox is Fidelity’s end-to-end omnichannel technology platform and payment gateway.

Get ready for secure payments optimized for your industry.

Whether you accept payments in-person, online or via a mobile app, Cardknox provides you with one streamlined solution for the best in secure payments. Cardknox’s solution is designed with both customer and merchant in mind, and is the best solution for businesses and nonprofits alike. Enhance the customer experience, boost efficiency, and cut costs with a flexible and advanced secure payment solution.

Learn More

Experience our powerful suite of omnichannel payment solutions.

Cardknox is the leading, developer-friendly payment gateway integration provider for in-store, online, or mobile transactions – hassle-free. No payment integration is too complex: Our solutions make even the most difficult integrations that much easier, so you can get exactly what you need in a lot less time.

Learn More

Painless Payments – Wherever You Are

In Store

Online

Mobile

Unattended

Equip your Retail Merchants with cashierless checkout systems. We offer sleek hardware with customizable displays.

WHAT MAKES US DIFFERENT?

The Fidelity Advantage

TWO DECADES OF INDUSTRY KNOW-HOW

Our team understands the complex and fast-changing world of payment services and puts that expertise to work every day to help your business thrive.

PERSONALIZED TECHNOLOGY SOLUTIONS

No one-size-fits-all solutions here. We give you the flexibility and control to design your payment processing system around your business’s unique needs.

LOWEST RATES, NO HIDDEN FEES

Our unique IQM technology analyzes, monitors and optimizes every transaction to ensure you get the lowest possible rate, every single time.

24/7 HANDS-ON CUSTOMER SUPPORT

Questions? Our caring, knowledgeable, in-house experts will get you answers fast, so you can make the most informed decisions for your business.

Two Decades of Industry Know-How

Personalized

Technology

solutions

No one-size-fits-all solutions here. We give you the flexibility and control

to design your payment processing system around your business’s unique needs.

Lowest rates, no hidden fees

Our unique IQM technology analyzes, monitors and optimizes every transaction

to ensure you get the lowest possible rate, every single time.

24/7 Hands-on Customer Support

Industries We Serve

Health clubs

Amusement parks & recreation center

Cities & municipalities

Zoos & wildlife

Auto repair

Grocery & supermarket

Pharmacy

Restaurant

Car rental

Apparel & fashion

Jewelry

Waste management

And More…

Amazing experience! Michael guided me exactly to the services we needed, and got us fully up and running on schedule despite our very tight deadline. The pricing is super competitive, and the experience was a breeze.

”Getting started is quick & easy.

Outreach & Discovery

Either you reach out to us, or you’re contacted by a Fidelity Account Executive

Statement Solution Analysis

We review your statement and your business’ needs in order to devedlop a pricing quote and payment solutions plan

You receive a proposal

You’re satisifed with your proposal, and your application is submitted to the processing bank for approval

Seamless Account Onboarding

You’ve reviewed and are satisfied with the proposed solutions and costs

Your Account Goes Live!

Your merchant account is approved, and your software and hardware is deployed to you

Ongoing Support

Your Account Executive is always a quick call or email away should you have questions

01

Outreach & Discovery

02

Statement & Solutions Analysis

We review your statement and your business’s needs in order to develop a pricing quote and payment solutions plan.

03

You Receive a Proposal

You’re satisfied with your proposal, and your application is submitted to the processing bank for approval

04

Seamless Account Onboarding

You’ve reviewed and are satisfied with the proposed solutions and costs

05

Your Account Goes Live!

Your merchant account is approved, and your software and hardware is deployed to you

06

Ongoing Support

Your Account Executive is always a quick call or email away should you have questions

Extremely Helpful and Professional

I have spoken to one of your customer service representatives on several occasions, and she has been extremely helpful and professional. She is an asset to your company. I would highly recommend Fidelity in the future, due to my experience with your customer service team.

More Than I Could Ask For

As usual, your customer service team did more than I knew I could ask for--before I even asked.

More Than Satisfied

Every time we call your customer service department we are MORE than satisfied. As the customer service manager of our company, I would hire them on the spot.

Great service!

Knowledgeable, quick, responsible tech support. Highly recommend this company to anyone.

5-Star Recommendation

By FAR the best credit processor I've worked with (and I've worked with many).

Amazing Customer Service

Fidelity has an amazing customer service! It doesn’t matter how much business you do with them, they will always set you up as a priority customer.

Nothing short of amazing!

Fidelity Payment Services always answers my questions and are always willing to help. I highly recommend them for any of your processing needs.

Devotion and constant support

I am highly satisfied with Fidelity's services.Their staff is knowledgeable, professional and always available!

JOIN 25,000 BUSINESSES USING FIDELITY TO GET MORE DONE

Ready to chat with a payment expert?

Get the Inside Scoop on Fidelity News

By clicking 'Subscribe', you agree to our Privacy Policy.